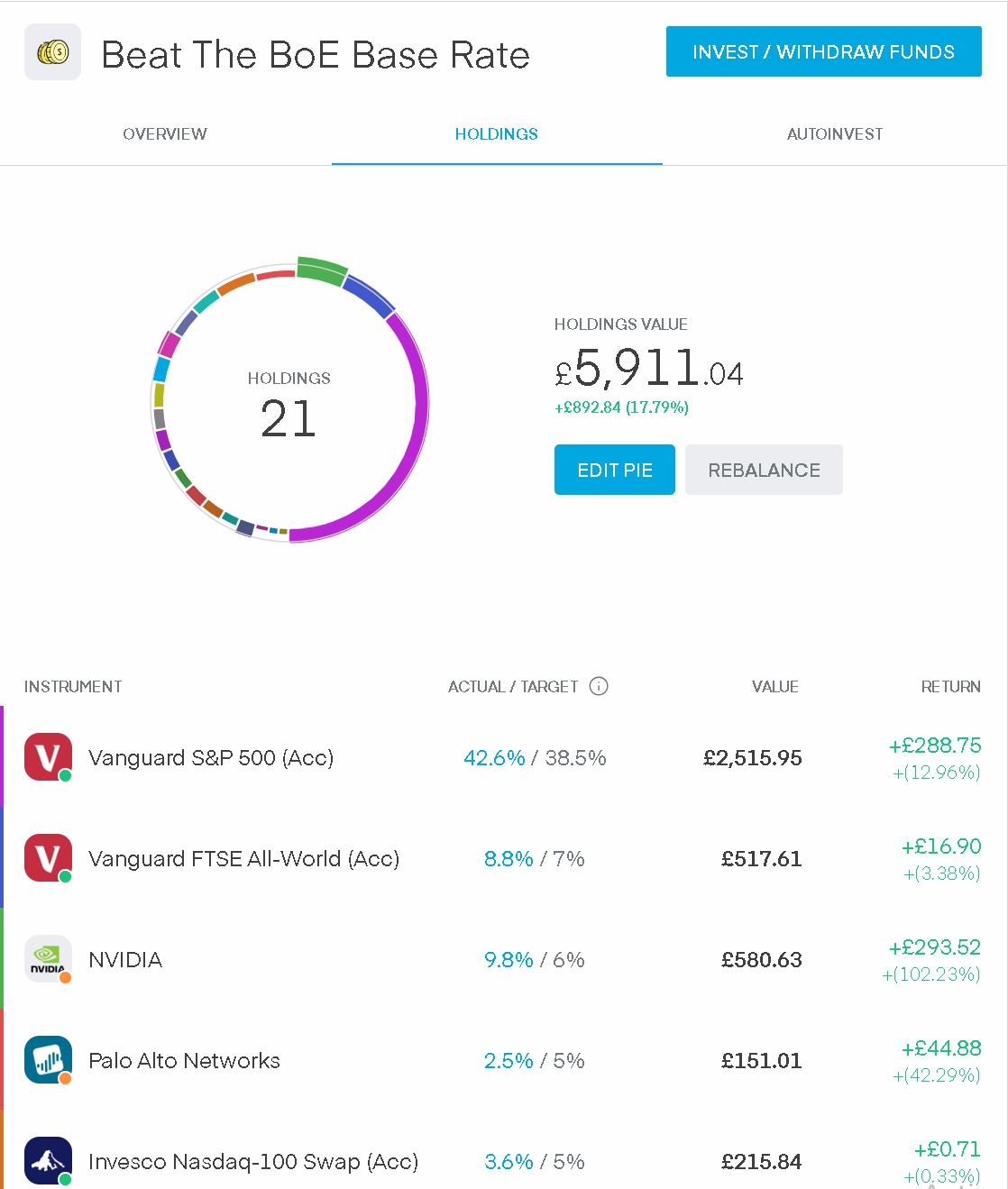

A Look At My Stocks & Shares Portfolio

Until very recent (ie the last 9 months), I haven't been bothered about stocks and shares so as an experiment I decided to create an account via Trading212 with the purpose of putting in about £200 a month in over 10 years. My aim is to have enough money invested/compounded in that I can pay a substantial chunk of my mortgage off.

I figured that compounding could a useful thing for me. After all, its only what banks do with their cash right.

In order to ensure I did have some cash for my "rainy day" fund, I decided to settle for putting £259 a month into a cash savings account and £200 into this Stocks & Shares ISA.

Given I'm a single bloke with a mortgage and many other bills to my name, I've got to keep finding ways to be smarter with my cash and I figure this is one them.

So far since opening up my Stocks & Shares ISA, lumping some cash in and then a set £200 a month, I've got a growth so far of about 17.5% on average. That really is a fantastic return for someone who is "rookie" at something like this

In this blog post (which I feel is probably going to be long as I'm at Blackburn Audi waiting for my car to be serviced while typing this) I'll explain some of my choices of why my Stocks & Shares ISA is structured this way.

My current Stocks & Shares Portfolio aptly named "Beat The BoE Base Rate"

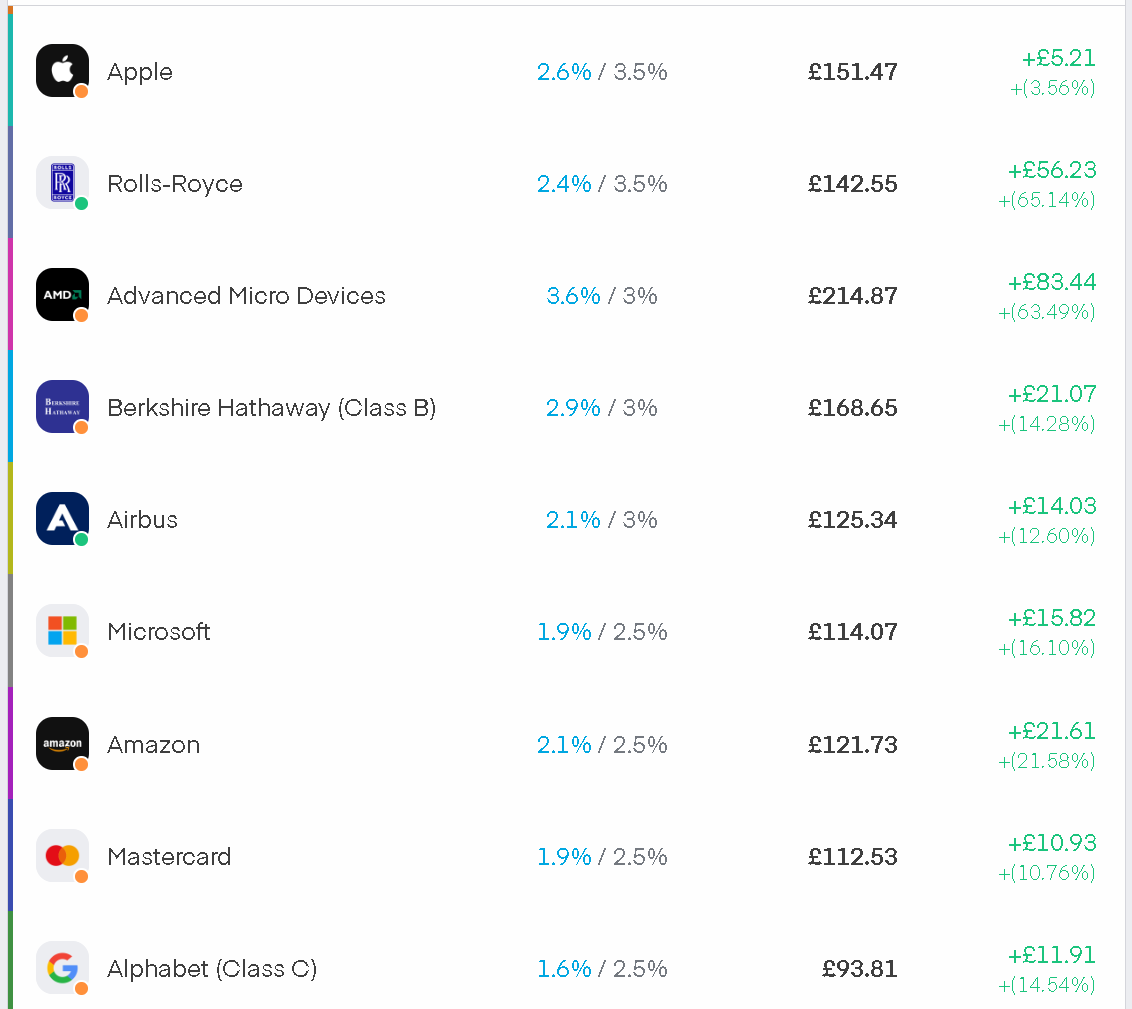

Vanguard S&P 500

Friends often tell me diversification is key when investing in stocks. What better way to diversify than going into a cheap S&P 500 fund? Why Vanguard and not iShares or Invesco? honestly I just went for the one with the cheapest management fee! With the Acc index fund, I don't need to worry about dividend payments and reinvesting as its done automatically for me.

Vanguard FTSE All World

This I've only added since the new year (I did hold the all world high dividend) but seems to be doing ok for the time being. Again given the ETF has over 3000 companies listed in and no doubt some will be duplicated to the S&P and Nasdaq (which I will comment below) helps me balance that element of risk out.

Nvidia

As a PC gamer myself and knowing that Nvidia has the mind share when it comes to PC gaming, it was always going to be obvious that Nvidia would be a good company to invest in. I've been proven right so far. Although I feel this "tech boom" won't last forever, simply because AI will become more regulated, I'm pretty pleased with myself that I put my initial investment in this.

I don't see Nvidia going away any time soon and they'll be here for the long run

Palo Alto Networks

My bread and butter job is in telecoms and I work on the networking and security side for enterprise customers but I work with Fortinet and Cisco hardware. With that in mind, since the whole COVID episode, many companies went online and a lot more focus came on Cyber Security as a necessary product set. Palo Alto are a massive established vendor in this field. Why not Fortinet instead as I work with them. Working with them day in day out highlights the bugs in this software and I feel their product set is a little too broad for my liking although I do expect them to challenge in the years ahead. I guess ignorance is bliss right?

Nasdaq 100 Swap

This is a very recently addition and I've been humming and ahhing about this for a good month. Given you'll see later down the line how "tech heavy" my stock is, I thought about possibly consolidating my stock into an ETF. Given there's some additional companies that make up that 100 stock (but 25% is atleast tech), I'll be watching this with interest over the coming year. Consider this one a trial by fire? There's no real data either to go off its performance.

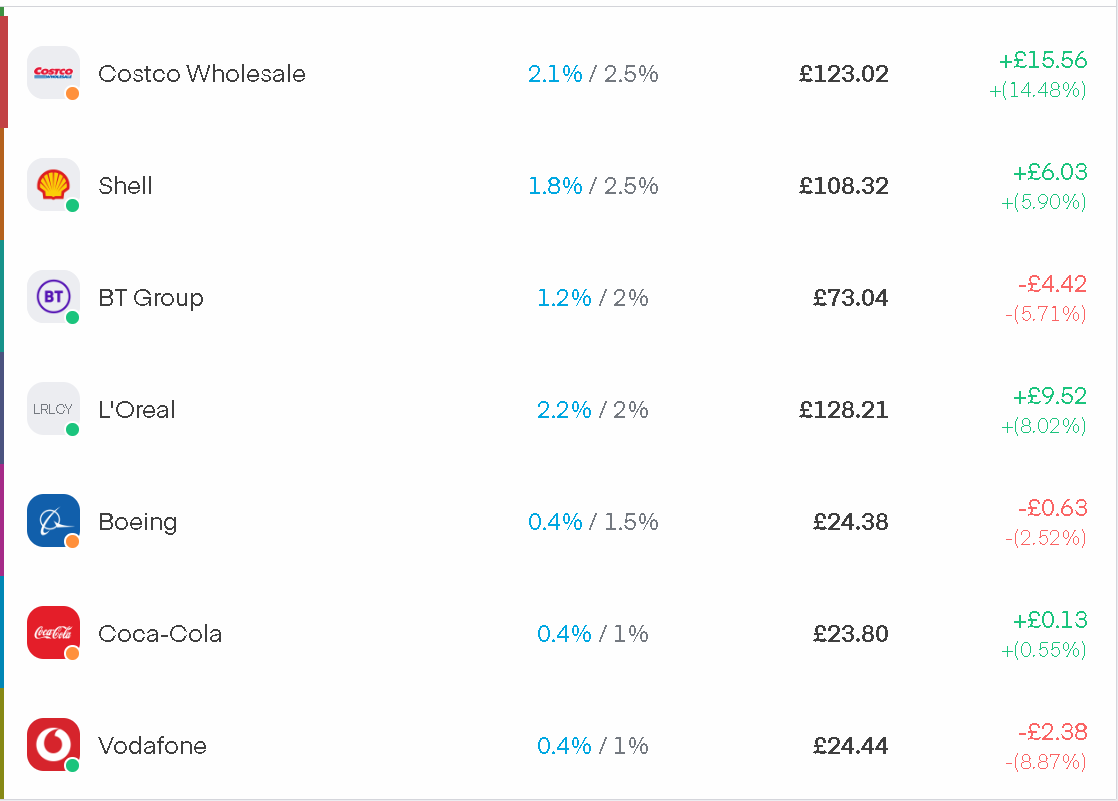

Apple

I'm personally not an fan of Apple products. I find them too restrictive and feels like you're being babysat but I can't argue with their profit margins! Also research suggests Apple has been growing slightly in the computing space. Selling more iPads/Macbooks, developing their own SOC (CPU chip) amongst branching out into other products.

As successful as Apple are, I think they know their iPhone product has to evolve pretty soon and they also know that people will buy it regardless of the price they put out. I mean without trying to sound disrespectful or sounding like a twat, they could create a product called "iDildo" and as long as it's got an Apple logo on, it will sell well and probably sell more than whatever is out there now.

I don't think anyone's portfolio would have Apple missing to be honest.

Rolls Royce

I have a keen interest in aviation and Rolls Royce are the exclusive engine option for the my favourite plane currently in production, the Airbus A350. Rolls Royce is an interesting story. I remember their share price at 70p and now these days its circa £3. I feel the future is good for them. I have no doubts that the "neo" variant of the A350 will feature an exclusive Rolls Royce engine and I see them venturing back into the narrow body engines too given the rise of developing countries preferring aviation over rail for domestic trips.

AMD

AMD has many fingers in many pies in the computing space. They aren't only in data centers, they power the most popular games consoles and personal computers. Lisa Su the current CEO has really turned things around and again I don't see this company going to the brink as it did before.

Berkshire Hathaway

Warren Buffets company. Truth be told, I didn't do much research into this company as a whole. I know of Warren Buffet (who doesn't!) and I know Berskhire has many holding investments. They turn a profit and post good results.

Airbus

Following my interest in aviation I decided to invest in either Airbus or Boeing. As you can see from the gallery above, I decided in the end to invest in both. I initially chose Airbus because of the markets overall. Asia have typically preferred Airbus over the years and Europeans generally buy a lot of Airbus. Since their A32x series of aircraft is very successful and not to mention, they make the A350 aircraft, it made sense for mas a fan fare of love per say. Not to mention I do like the A380 aircraft as well as their very new A220 series. That baby whale noise. If nobody knows what I mean, here's a snippet

Airbus A220 Noise

Airbus A350 noise powered by the Rolls Royce XWB engine

Microsoft

Everyone even who lives in a cave knows of Microsoft. Bill Gates founded company that does cloud computing, console gaming, software and other hardware like the Surface Pro I'm typing on. Solid bet as a company for the years ahead.

Amazon

The shopping conglomerate that has killed the traditional high street shop. Not only have they cornered the market in shopping, they've ventured into producing TV shows and movies some of which are actually good!, they also do smart connected homeware to cloud computing storage. Again, they aren't going nowhere for the next 20 years atleast!

Mastercard

Do you remember that advert, "for everything else, there's Mastercard", it's always stuck a chord with me. Today's major world its either Mastercard or Visa. Sure you've got American express out there but only posh twats have that card and most companies frown upon you using it. Given the last major thing I saw between the Visa and Mastercard was spat was about fees, I just picked one of them which was the cheaper stock price at the time. My bank cards are Mastercard. I don't see them or Visa being shifted any time soon. We all need to use some form of card transaction to pay for stuff these days.

Google/Aphabet

Another tech company to invest in. I bet you use a Google powered software or product to probably read this blog! Chrome/Chromium, Android OS, Android Auto, Smart Home connected stuff, YouTube, you name it. It's not to say they don't have a graveyard of products though. But for the last 20 years, they are still about. I suspect Google will continue to be about for a while yet too!

Costco Wholesale

My logic behind this involves exceptionally little research which you could argue is naïve on my part. Everyone needs food to live. We buy from supermarkets food and in todays economy of rising bills, people buy in bulk to secure a discount. Costco are a global entity that deals in bulk food buy discounting. I've personally never been in one as I'm not close to one but I feel my logic is sound here and so far its paying off.

Shell

I have a love hate relationship with Shell. I mean from a standpoint of owning an Audi A4 diesel, the Shell Garage 7 miles away is the cheapest in the area for fuel, but I don't like how much of a profit they rake in. I mean they get lucky finding areas to mine the monkey out of to get the dinosaur juice out of the ground.

Having said the above, we all need fuel as it stands for our cars, ok well the majority of us (if you are reading as an electric car owner). I firmly believe electric is a fad we and we will move to some hybrid variant of Electric and Hydrogen. Shell along with the other fuel courts will find a way to keep in business and I reckon Hydrogen is the way forward. Especially as news that Rolls Royce is experimenting with them for their jet engines.

BT Group

BT, well a long time ago I used to work for them. They have a massive monopoly on infostructure here in the UK but as one my friends Owain rightly pointed out, BT is a Global business and there's more to just the retail and Openreach arm that I'm aware of. Given I work in telecoms and BT rake in profits the dozen, I reckon keeping BT about will give some payments in dividends (not that I'm arsed in the slightest about that) but will give some form of stability too in the ever changing tech world. Even if BT Retail doesn't make money, EE, its mobile operator arm and Openreach will bum every operator out there and make plenty.

L'Oreal

Cosmetics. I'll be honest, I'm not a massive user of L'Oreal products but the reality is I don't have to be. It's a huge company and lets be frank, every woman loves cosmetic products. It's going to be around for a good while and its another diversification. Also my best friend at work, Bilal has pristine hair and one day I may even be able to get a special bottle saying because he's worth it just as a practical joke.

Boeing

This is a very new investment. New as in circa this week. In hindsight I would have done it before the air show last year but here we are. I've not jumped at Boeing as I personally find they craft more function over form and as a passenger in economy, I find it crammed and uncomfortable when compared to the Airbus equivalent. But ultimately that is my emotion getting in the way of investing. I often read that no emotion should be put into investing but I find that very hard. You have to care about the company you want to be part of in my opinion.

With Boeings recent problems with the 737 MAX series of planes and delays to their new 777 lineup, prices have taken a considerable tumble, much to the delight of me as an Airbus stock owner but the reality is we all need Boeing to keep Airbus honest. Boeing won't go out of business. They're literally too big and given there's so many Boeing planes out there, they need servicing etc. Once Boeing get their act together, long term I expect both Boeing and Airbus to prosper. Boeing may take a little longer given they will need to burn through cash I suspect.

Playing devils advocate, Airbus will have to do another clean sheet design for their A32x planes at somepoint. Whats not to say they won't have issues themselves. Touch wood they don't.

Coca Cola

If its good enough for Warren Buffet, its good enough for me. It's a stock that won't move very much and is considered stable. It's readily available all over the world. It's only a small portion of my portfolio but its been around for so long its not going to go by the way side.

Vodafone

I admit, I was a bit iffy with this. Telecoms still being my bread and butter, I saw news about lay offs at Vodafone, re-structuring and mergers going off all made me uneasy about investing into Vodafone. In truth I could possibly drop this if I get the slightest bit of money in it. Having said that, I'm looking at it this way. Telecom networks have to invest large sums of money for next generation mobile networks. 5G in the UK is very much still a new thing and whilst most operators are mid way through their roll out, its still a considerable sum of cash to pump.

Given Vodafone has signed deals to use computational AI as well as laying off staff, I expect their balances to improve and as a result stock prices to go up. I'm still half tempted to dump this and place it into BT which I have a firmer understanding of but again, could be my naivety given Vodafone is huge huge global company. Case of we'll see

I did tell you this blog post was going to be long didn't I. Reading back I can see flaws in my investment. Some are driven by love and emotion but I believe if you research a company and what they do you won't stray that far away from some kind of a profit margin.

I'll try and post regular updates to this as I can. Whilst blogging isn't new to me, finding time to do it is.