An Stocks & Shares ISA Update

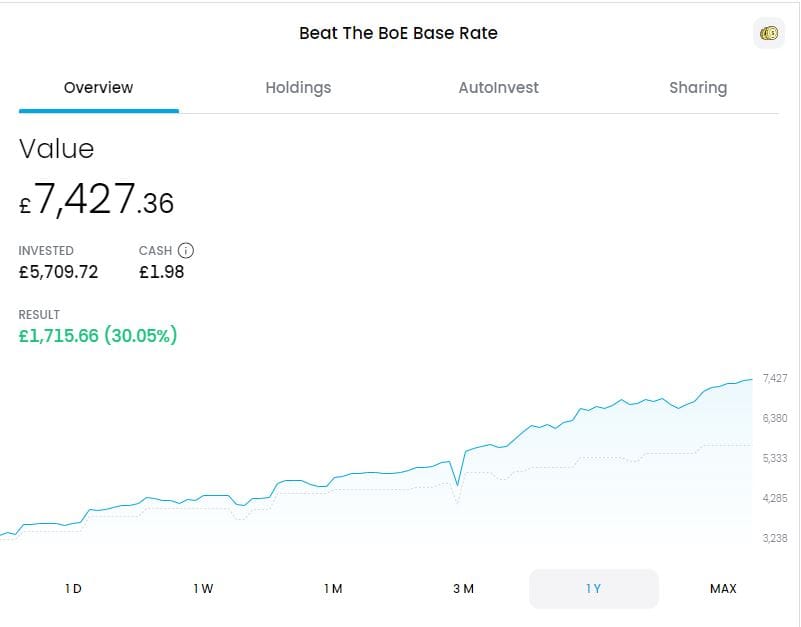

So it's been a couple of months since I did an update to the progress of my stocks and shares ISA. My last update was in February this year showing an overall growth of around 17%. Pretty impressive given my aim has always been to beat the Bank of England base rate. I'm typing this now seeing the overall growth at 30%!

Now before excitement comes in, I wouldn't get excited. There's a long way to get to where I want to be. I want to be over 100K in value before I actually see it as a meanginful investment. Without further a due, lets take a look and gander thoughts.

Full context of my ISA over the last year

So as you can see, there's been some really positve growth. Now as you can see, its not without its negatives but overall if I can sustain a 15% year on year growth for the next 10-20 years, I'd be elated with it. Let's delve into my thoughts;

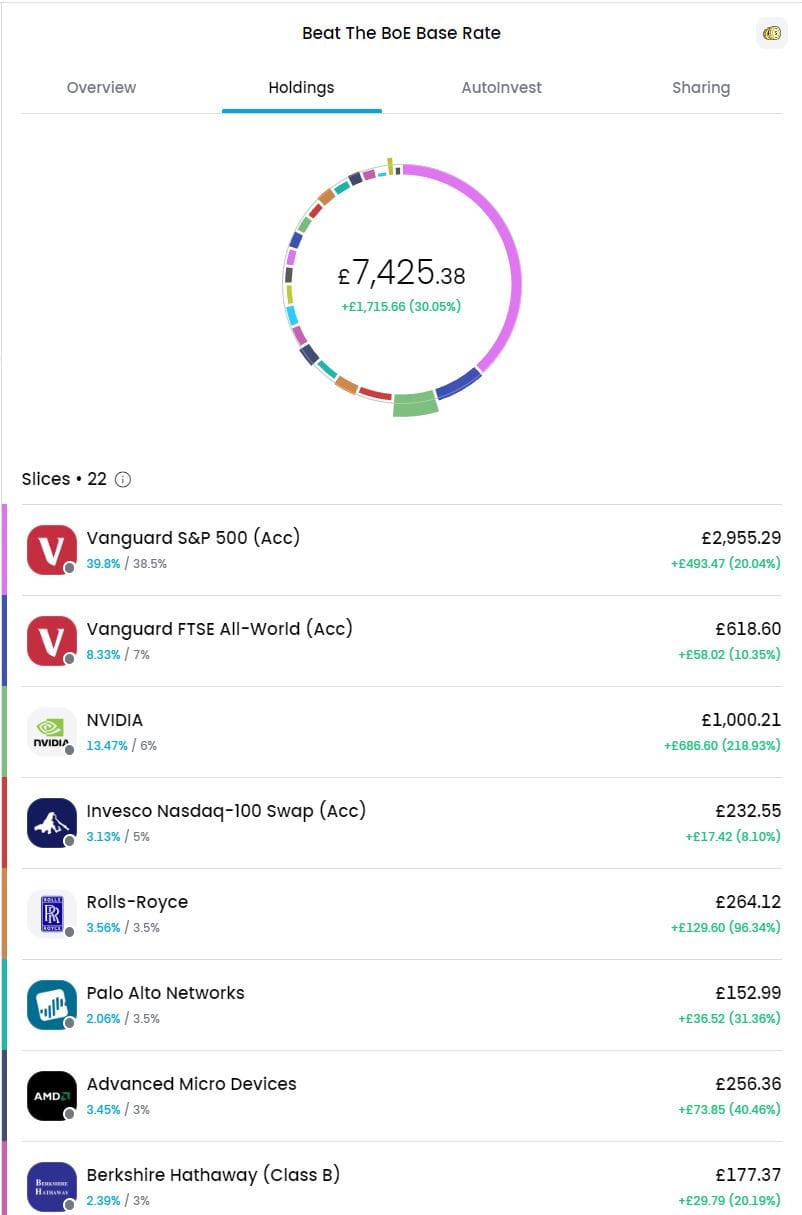

Vanguard S&P 500 (Acc)

The S&P 500 continues to stick to tradition of history with concurrent growth. Warren Buffet said the best advice he could give was to pay into an S&P 500 index fund. I have and thats what I'm doing. Current growth of 20% and its a relatively low risk fund is good in my eyes. Accumlating dividends automatically re-invested in so I don't have worry about it too.

Vanguard FTSE All-World (Acc)

This was more to ensure I got a really good diversification. I know there's some overlap here with the S&P 500 but it doesn't really bother me. Over 2500 companies in this and it will ensure a good spread. Growth may not be as impressive as it factors in more companies but with any profits made will automtically go back in I'll be happy with the growth.

Nvidia

You can see from the data above that the main growth driver in my portfolio has been Nvidia. As a PC gamer I've owned Nvidia graphics cards. They are good but they are also an enemy of PC gaming with their very high prices for products. I wouldn't be a miss though to acknowledge they are the forefront of graphical innovation at present. Ray Tracing, DLSS tech, are all a thing because of Nvidia pushing that out. Their foray into AI has been a monumental success and its showing in share price. Whilst i'm not Nvidias biggest fan, I quite like their share price and how its rocketed. My regret is I didn't buy more when I had the chance! It's quite ironic they were pretty much bankrupt and they went to Sega to ask for full payment of a product they hadn't built because they were on the verge of being bankrupt. Tables and fortunes turned eh?

Invesco Nasdaq-100 Swap (Acc)

This was more of an experiment in my head to see it was worth say selling my tech company stocks and consolidate into an ETF. Whilst there is still a thought in this, I'm going to continue keeping them separate. I wouldn't be a miss to say this ETF driver is probably Nvidias growth but I'm still impressed overall with it. For an ETF that I don't really contribute much into at all, it's provided some growth. Is it worth the continued charges of the ETF? I'm not sure yet. Would it be better served into the S&P 500 or the All World fund? Maybe. It's food for thought for me.

Rolls Royce

My love of Rolls Royce stems their plane engines. The roar of the Rolls Royce just in my eyes can't be beaten. I'm hoping to fly out on the A350 late this year. It's been so elusive this so I really can't wait to fly on it. Their stock has continued to rise and whilst people get a little jittery with its drops, I remember it being at 60p. My regret again is not buying more at 60p! I suspect Rolls Royce will continue to increase in the months and years ahead although not as rapid as recent. I'm sure they are banking on their ultra fan engine to make it into the new Boeing jet (not the new 777 but a narrowbody if they ever get back on the drawing board). I also suspect that any "neo" variant of the A350 will be down to Rolls Royce possibly and in the next 10-20 years I fully expect them to go back into the the narrowbody space which is now a huge market. Given Pratt & Whitneys engine problems with the A32x, I wouldn't be surprised to see them as an alternative.

Palo Alto Networks

They are a key player in the cyber security field and are still a good strong stock. Cyber Security is a very up and down field. Any intrusions generally take a stock hit but thats the name of the game. Threats evolve. I work with Fortigate firewalls day in and day out and I know in the common world now there's always going to be a need for Cyber Security. I'm happy with the performance of the stock.

AMD

I'm a big user of their products and who doesn't like an underdog? Under Lisa Su they have really turned it around and thats great for them. They are geniunely competitive in the CPU space consumer and enterprise, currently with a firm foot hold in the console space and are doing pretty well all things considered with their AI. Whats a concern is their graphics division. It's not just not there in comparison to sales volumes of that of Nvidia cards. The R&D budget in this space is nothing compared to Nvidia and I feel some real innovation and aggressive pricing needs to come here from AMD to compete. I own a 5800X3D CPU and an RX6950XT and I'm happy with the performance I get in my games but Nvidia's cards are just more efficient power wise and the mind share is all in thay direction too. The 7000 series ultimately flopped. I'd like to see them compete on the high end range and mid and low end range again but compete with price. Make it impossible to ignore. If it meant ditching the AMD part and splitting to an ATi by AMD or something I'd be fine with it. I prefferred the ATi name anyway! All that whinging though, there's still fantastic uplift in this tech stock so they're obviously doing something right.

Berkshire Hathaway

I think just about everyone tries to buy into it. A company with many fingers in many pies. Generally if they do well, you see a good performance in the S&P. Again, I don't invest very much into Berkshire with my limited monthly contributions but I'm very happy all the same.

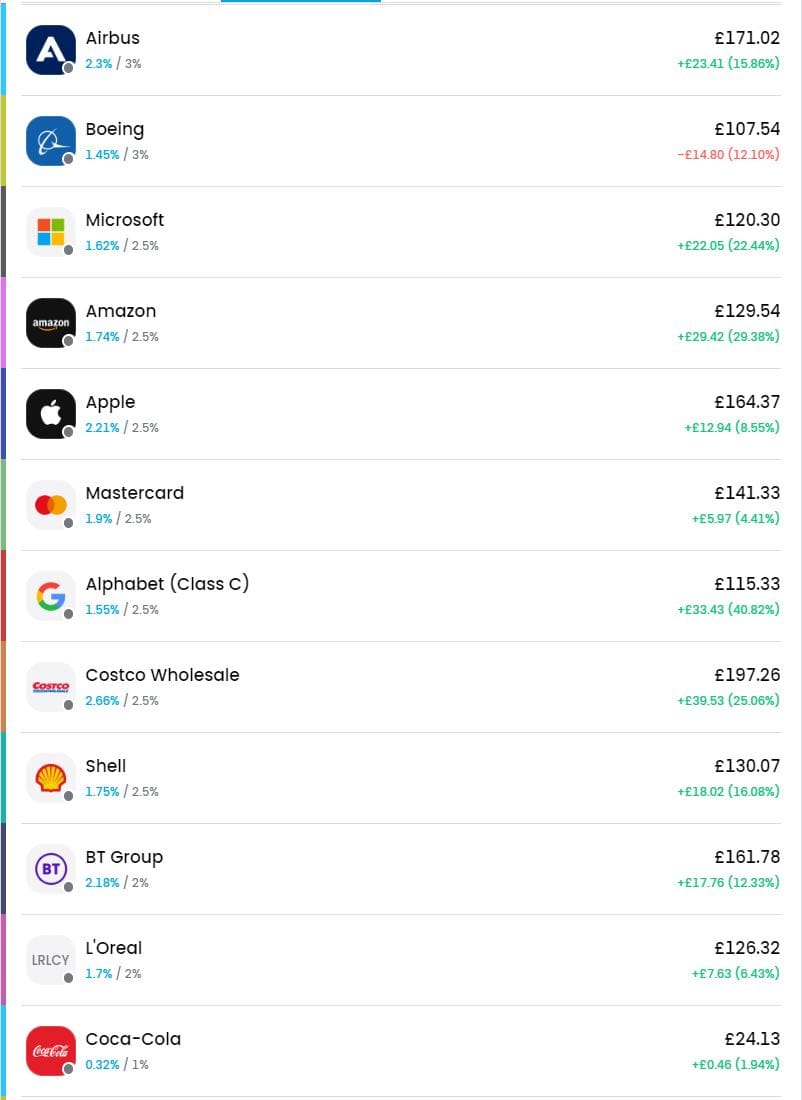

Airbus

I love aviation. I love the A380 and I love the A350. Performance of Airbus is always going to be positive, probably a little inflated given Boeings current struggles in the consumer space. Again, there's good growth and Airbus have captured a good number of orders for their craft or late. The backlog of the A32x continues to grow and is a major success. Airbus by now will no doubt be focusing on what will be the sucessor to this aircraft. Just because Boeing is struggling doesn't mean they can rest. Ultimately long haul travel will belong to both Airbus and Boeing so I feel both these companies are a safe stock. I'm hoping to see in the next 10 years a successor to the A32x announced with maybe an cut down Rolls Royce "Ultra Fan" engine as they've often said its scaleable.

Boeing

I'm not surprised this is my worst performing stock at the moment. They can't keep out of the news and are bleeding cash yet i'm still not worried in the slightest. I posted back in March this year why I'm not worried about Boeing and I'm still not now. Yes they have missed out on sales, but they are still selling planes. As long as they continue to have an order book, I don't see them really struggling. Ryanair has publicly backed them, Emirates are eagerly waiting for the new 777 9 and X variants as will other carriers. Their "Dreamliner" is still selling too. We as aviation passengers need Boeing to return to form to keep Airbus in check just as much. I'm not a fan of Boeing jets as a traveller, I find them quite tight and just "functional". There's no elegance like an A350 for example (bias I know) but we need new aicraft to keep travel affordable. I've been pumping in more money into this stock recently rather than tech stocks because I feel its undervalued at present and once it sorts the in house mess, it will return to the highs again. It's a long game. Boeing isn't going anywhere. Too big to fail for the US as a country.

Microsoft

Not much to say about Microsoft. Solid company really. Their gaming division seems to be a little in transition but overall, Windows isn't going anywhere, Office isn't going anywhere and their Azure hosting services are very competitive against Amazon so in short, solid stock and solid growth.

Amazon

I buy a load of shit from Amazon and lets be honest, their AWS space makes a shit ton of money too. It's another no brainer stock to hold really if you're in tech.

Apple

I'm personally not a fan of Apple products but from a business perspective you can't ignore them. They have great margins on their products and have convinced many their products are the way to go. Whilst I personally don't like their products as I find them too restrictive in every sense, you can guarantee the "next big thing" from Apple will be an evolution of their mobile phone and everyone will buy it like a flock. Foldable phone perhaps? The stock hasn't grown as major as I thought it would have but I have faith it will grow given their userbase generally tends to stick within their eco system.

Mastercard

Look in your wallet. You've either got a Visa card or a Mastercard or even both. They as a payment provider are global and aren't going to go anywhere soon. Again, I've not invested as much as I'd have liked into this but the small growth is nice to see. It's a safe stock.

Alphabet/Google

If you don't have an iPhone, you have an android based phone and I can guarantee you've had an gmail account or are even viewing this in a Chrome based browser. Google isn't going anywhere. Safe solid bet and again, very impressed with growth given I haven't done much investment to them.

Costco Wholesale

I'm happy with the growth of this but also not surprised by it. Shoppers mentality now has shifted to buy in bulk in the perception of saving money. It's really good growth and I suspect wholesale markets will continue a yearly growth as a result. Sort of like your ALDI and LIDL stores, they are here to stay.

Shell

We all keep hearing "EV is the future". Me personally, nah. I think Hydrogen is the future. Whilst the world makes up their mind, companies like Shell will continue to milk that dinosaur juice for all its worth. Shells forecourts aren't going to anywhere and I suspect companies like Shell will have a major say whether EV takes off.

It's not in Shells interest for EV to take off and I think they'll back hydrogen personally. I expected this stock to be volatile but it's still in the green.

BT Group

They just announced their recent financial results and they were overall very good. This saw a surge in the share price which has massaged my overall growth. BT will continue to trim the fat in the business in the years to come. Decomission of smaller exchanges and possibly selling land, removal of copper in their telecoms network in favour of fibre will continue to bring in a pretty penny and cutting down staff as businesses merge.

I personally work in the telecoms world and can see how BT has changed over the years. I used to work for them back in the day. They will still be about. I suspect that Openreach will eventually be separated from the BT Group business at somepoint, hell it may even be owned nationally but you can guarantee they will continue to make money in mobile space and fixed line connectivity. I suspect this will be a slow burner.

L'Oreal

Every woman buys cosmetics. I don't have much of my portfolio in L'Oreal but they will be a company that will be about in 20 years or so time so I'm not worried in the slightest. This again will be a slow burner I suspect.

Coca-Cola

Talking of slow burners, this really will be a slow burner. Everyone consumes Coca Cola globally and again they won't go anywhere. The company has sort of been in this random holding pattern for the last 4 years. Will they eventually take off. I geniuenly don't know. It's seen more as a safe stock than anything else and from movements I've seen, that's pretty much the case.

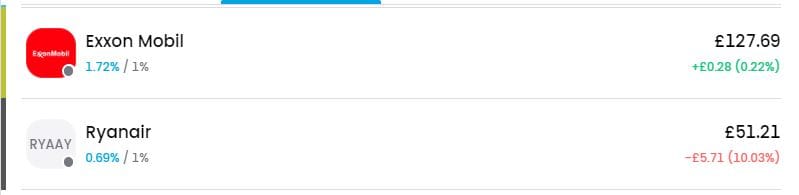

Exxon Mobil

The stock I 100% bought at the wrong time but will keep. This goes up and down more frequent than someone getting dressed and undressed. I'm always tempted to get shut of this stock especially given how small my investment is, but see my comments re Shell.

Ryanair

Make no mistake, I despise this company and everything it stands for but what I can't argue is how much of a success they are. They are the biggest airline in Europe, have the biggest fleet in Europe and recorded the biggest profits of any European airline. They are in the red now but they are a massive backer of Boeings 737 MAX line of jets. I suspect when they renew their fleet out there will be a surge in profitability here. I "should" invest here but its Ryanair man lol. I know your emotions shouldn't come into investing, but its Ryanair. If this was Cathay Pacific or even Singapore, I'd be like flies round shit. Maybe once I see profit I'll get shut of this.

Concluding Thoughts

Look it's been really good growth, been twitchy at times but held my nerve and sticking to my principles of;

- Do I think this company is necessary in the world?

- Is there a need for this company in the world?

- Do I understand the company enough to understand what they do?

If the answer is yes, I continue to invest. Let's all hope for more continued growth in the months and years ahead!