Stocks & Shares Update January 2025

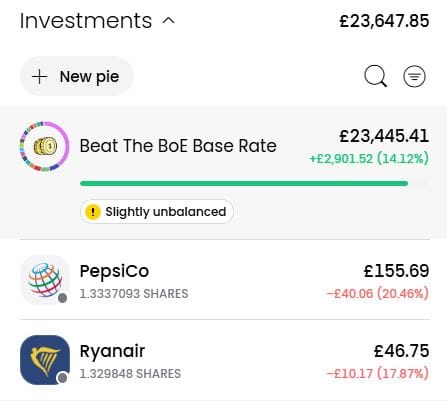

So I guess I should update where I am status wise with my Stocks & Shares ISA. Happy to say, on the whole its going well.

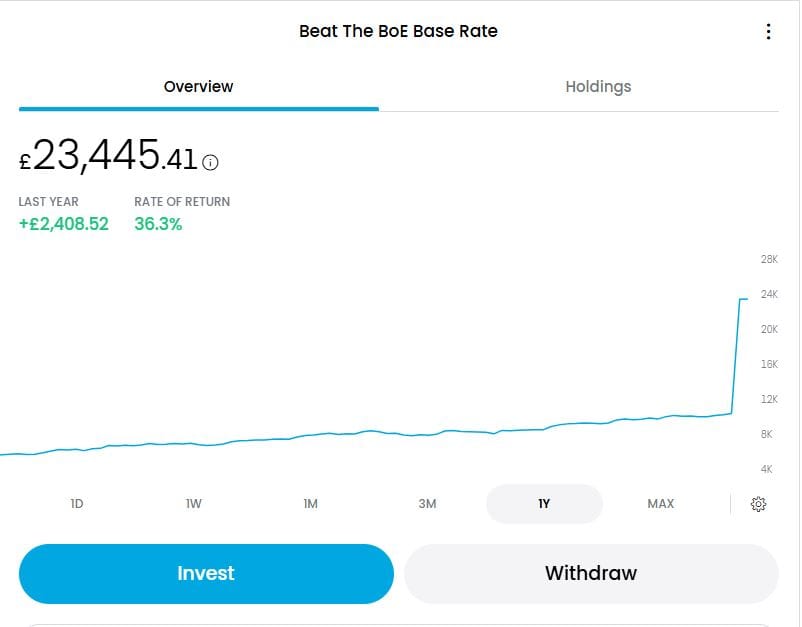

Through persistent overtime at work, its enabled me to pay off my Audi A4 at £400 per month. I now officially own my car as of November 2024 which was a great feeling. Since being in Thailand I had mulled over whether keeping a large cash balance in a Cash ISA was worth while. £18,000 at 4.9% isn't bad, but I thought I could do better so I made the decision to move £13,000 of this into my Stocks & Shares and keep a small cash balance on hand for anything else. Here's how my Stocks & Shares look now;

How my portfolio looks in January 2025

So I guess I should get this out of the way and say prior to the £13,000 the pie stood at something like 41% up. Given the considerable investment into it, I expected the figure to down.

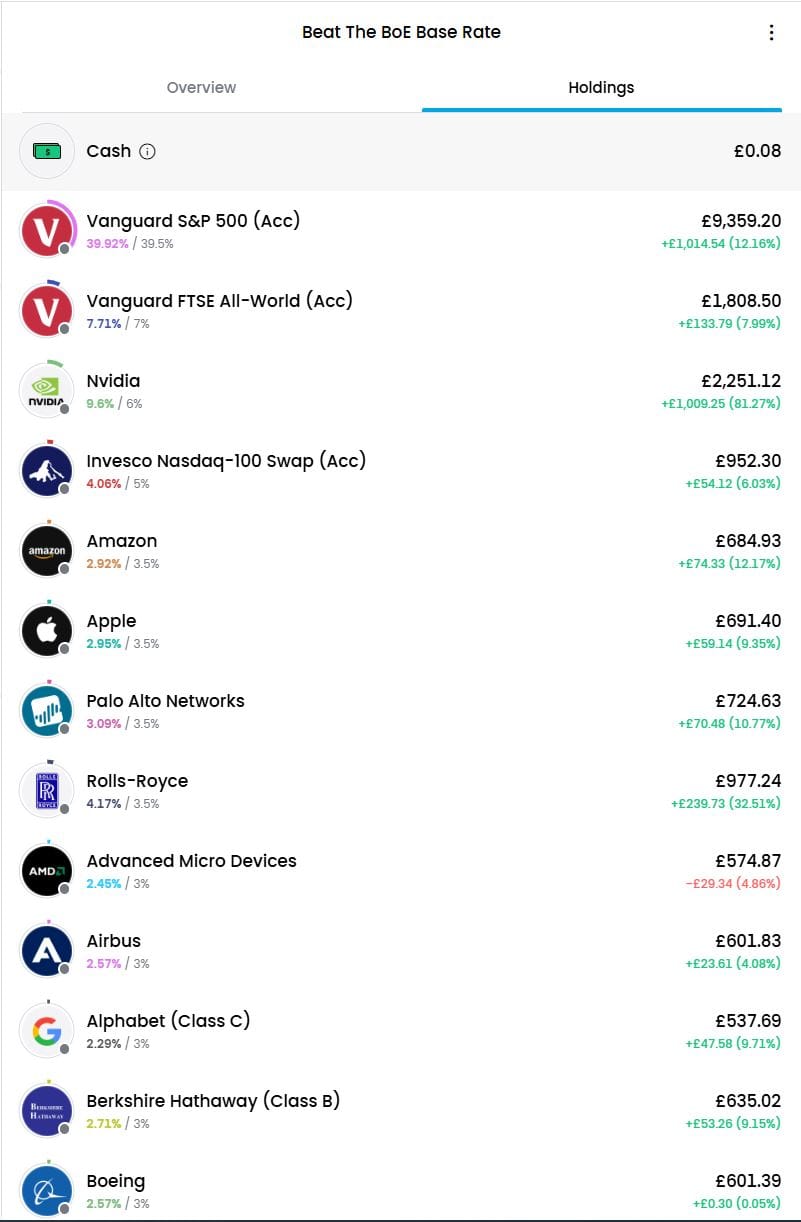

Whilst we're talking about changes, lets have a quick natter about how BT Group and Coca Cola is no longer in my portfolio.

Sold

BT Group

I'll be honest, I work in telecoms and whilst I see BT bringing in more profit long term, especially when all the copper is sold off and telephone exchanges are decomissioned, their massive, massive workforce requires a big pension fund. I could have kept in BT and got some dividends from this and seen probably slow growth, but I just figured since I'm up, I'll just cash it out.

I still see BT Group as solid stock long term but no regrets of moving out of this.

Coca Cola

My stock in Coca Cola was tiny and I whilst it's a stable company its holding pattern the company seems to be in suggests to me they are unsure on a direction. My stock was up £5 and I only had about £30 worth ot stock. It wasn't worth a hold in my eyes so I got rid as a profit.

Bought

General Electric

It's no secret I have a love of aviation. I feel in Rolls Royce and General Electric will continue to power widebody aircraft and I feel they could maybe team up potentially for a narrow body engine of some kind. If they didn't team up, I still feel that General Electric have the means to be profiable.

Future Changes

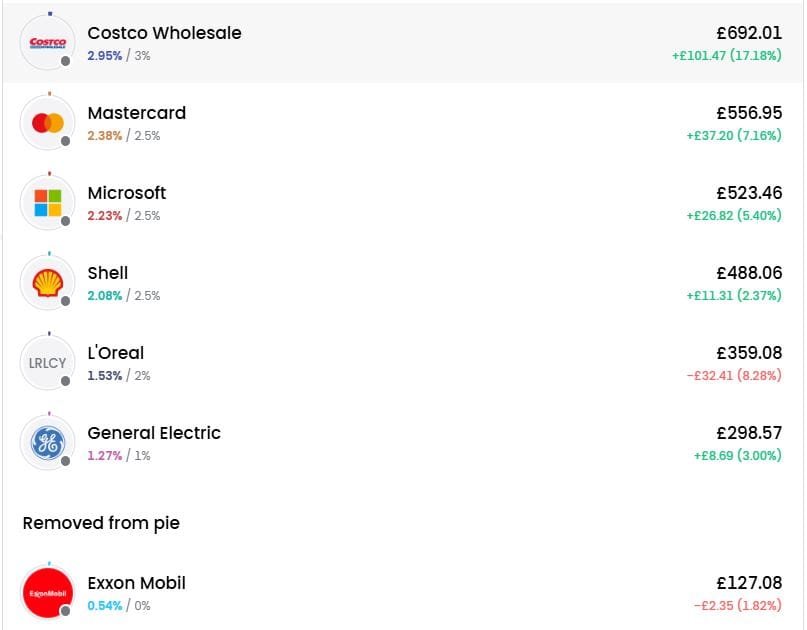

You'll notice from my screenshots above I've taken out Exxon Mobil, Ryanair and Pepsi from my pie. Whilst I feel Pepsi is still stable, it annoys me that my shares are worth less. Mind you, I have got the money back in its dividend payments, but I've not added to it. Exxon Mobil I will sell off and re-invest this into Shell so the money will stay in the energy market. I feel Shell whilst it makes less profit than Exxon, is better aligned in regards to researching and trying to move forward on new fuels where Exxon is less so.

My biggest regret is Ryanair. I despise the company, I'd never fly them if you paid me and I bought them at the wrong time. When they turn a profit I'll be immediately out of this. I'd love Trading212 to allow Cathay Pacific & Singapore Airlines to be tradeable instead but they don't. Really should put a ticket requesting this.

Reviewing My Stocks

So ok let's get this out of the way then 😄

Vanguard S&P 500 (Acc)

It's going well. It's got good growth and its a solid bet. If there's anything I'll consolidate all my shares into it, it would this index fund and the All World Index. As long as this stays green, I'm happy 😊

Vanguard FTSE All-World (Acc)

Whilst some of the stocks are a copy from the S&P 500, I still maintain its good to have the mass diversity and its paying off.

Nvidia

I have a love/hate relationship with this company. I'm an AMD user personally and I don't like Nvidias Ray Tracing bullshit or its route of AI super sampling in DLSS (I think its bad for gamers and Pc in general) or their prices, but it continues to make money. Last year it did the 10:1 stock split which on paper I came out pretty much smelling roses with. I don't know how far Nvidia will go but given the advancements they are making in the data center world and with AI, I think its worth holding onto still.

Invesco Nasdaq-100 Swap (Acc)

This continues to be an experiment which is going very well although I do have concerns about the index fund costs as this balance hold grows. It's possibly one I may shift out of at somepoint, or not. Honestly don't know. As long as it's green and it climbs it will stay about.

Amazon

It's Amazon. It's never going to go down in price. I still buy stuff from Amazon, as do you. Their AWS space is still growing too. Honestly why wouldn't you hold this stock?

Apple

See comnents re Nvidia and they apply here. I don't like Apple products but they sell well, margins are good. Safe stock. Let's be honest here, if Apple created an product called "iDildo" every woman would buy it.

Palo Alto Networks

Todays world needs Cyber Security and Palo Alto is doing very well. Robust product set, don't do anything too crazy (unlike Fortinet with their mass products). Palo Alto also did a stock split of late. Whilst I didn't come out great (mainly because my holding wasn't that much), its still a good stock to keep invested in. Cyber security field is a very real thing now.

Rolls Royce

Whilst growth in Rolls Royce has predictably got slower, my love with Rolls Royce engines continues, especially given I've just come back from Thailand on Air China A350 aicraft, which Rolls Royce is the exclusive engine option. I'd like to see Rolls Royce get the Ultra fan tech sized down and a "neo" variant be created for the A350 as well as an exclusively poweing Airbus' next gen narrow body. It could be an exciting time this. I'm just talking about aviation here, not the other possibilties such as nuclear power, etc

AMD

AMD in the CPU world is on a roll with their Ryzen CPU's. Struggling in the GPU world, doing ok in the data center market and now coming into the world of AI too. AMD will no doubt also power the next gen consoles again too so I see this again as a relatively safe stock. Lisa Su really turned around the ship at AMD and credit to her. I do wonder long term when Su leaves, what will happen at AMD. Will it regress again? Surely Intel can't be bad on the CPU front for the next 5 years?

Airbus

I did a previous post about aviation and I still believe what I said before. Airbus and Boeing are going nowhere. Airbus' back log is substancial. Fair enough not made ground on Boeing in terms of getting aircraft out of the door but the backlog is good enough to say its a good sound investment. Whilst its unlikely Airbus will sell massive in the American market (President Trump will probably ensure this by tariffs), Airbus has done well in the Indian market and also done very well also in South East Asia. Having been on the A350 too, I can truly say its a fantastic aircraft and better than the 787 Dreamliner series from Boeing. I expect the Airbus A321 LR and XLR respecitvely to sell really well and open up new routes. Given there's no real competitor from Boeing in that particular aircraft, this could be very profitable.

One caveat to look at with Airbus and Aviation in general is the mass investment needed in clean sheet design aircraft. Airbus will have no doubt started looking at what succeds the A320 series aircraft, their most successful and profitable jet. This would suggest we may see a cash burn from them at somepoint.

We all use a Google product. I'd be very surprised if you didn't. Whilst Google continue to piss me off at times, to a point where I consider "de-googling" my life, ultimately they are still a top dog.

Berskhire Hathaway

When this company does something you generally sit up and take notie. They don't make mistakes and whilst they continue as a company to be cash flush, they also still have fingers in many pies. Keep holding.

Boeing

I was adamant that Boeing long term will be fine, in a previous dedicated post I said as much and I still thikn that now. They will take a while to recover but long term they are not going anywhere. American market and economy needs them. Not a fan of their aircraft (the 777-X may change that!) but aviation needs them.

CostCo

The craze of bulk buying still going strong. I will continue to build on this stock until I see a point where traditional sensible shopping as I call it returns. On that point, I see people will continue to bulk buy especially in tight shrinking economies coughEnglandcough.

Mastercard

For everything else, there's Mastercard lol. Oddly now I have a Thai bank account, I have to pay £6 a year for the privlidge to have a Mastercard debit card. In South East Asia, Visa and Mastercard appears to be a bit frowned upon due to the fees involved. I still feel both Visa and Mastercard are going nowhere and these are solid bets. I don't expect mass growth from this, but I expect it to be a steady line.

Microsoft

We all use Microsoft products, love them or hate them. I mean fuck, I use a Windows PC only because Microsoft Flight Simulator 😸. Sure there's those office products and Azure and they make silly profit so yeah you should keep the stock haha.

Shell

I said to myself at the start of this year do I get rid of Shell or Exxon Mobil. It was the latter. Shell's exploration into other fuels for me suggests long term they know dinosaur juice has a shelf life and EV in my eyes is still a fad. I'm sure big companies like Shell, BP have got Hydrogen locked down and this will be the fuel going forward.

L'Oreal

I don't really fully understand why this stock is down to be honest because financials wise they look solid. I absolutely maintain this continues to be a good stock because every woman uses cosmetics and L'Oreal is so well known I don't see this not making a proifit long term. I'm sure "its worth it".

General Electric

See above comments

Conclusions

It's going ok, I'll keep putting some money each month into this and I hope I broach the £100,000 within the next 10 years. I'd love a million but I can't see that happening within 20 years unless I somehow got really lucky.