Stocks & Shares Update July 2025

So it's been a while hasn't it? A lot has happened. Me getting fitter, pulling my calf many times, getting fitter, even sorting out a pesky issue I have with Ghost Blog. I'm not forgetting either President Trump acting like a wanker with tariffs too.

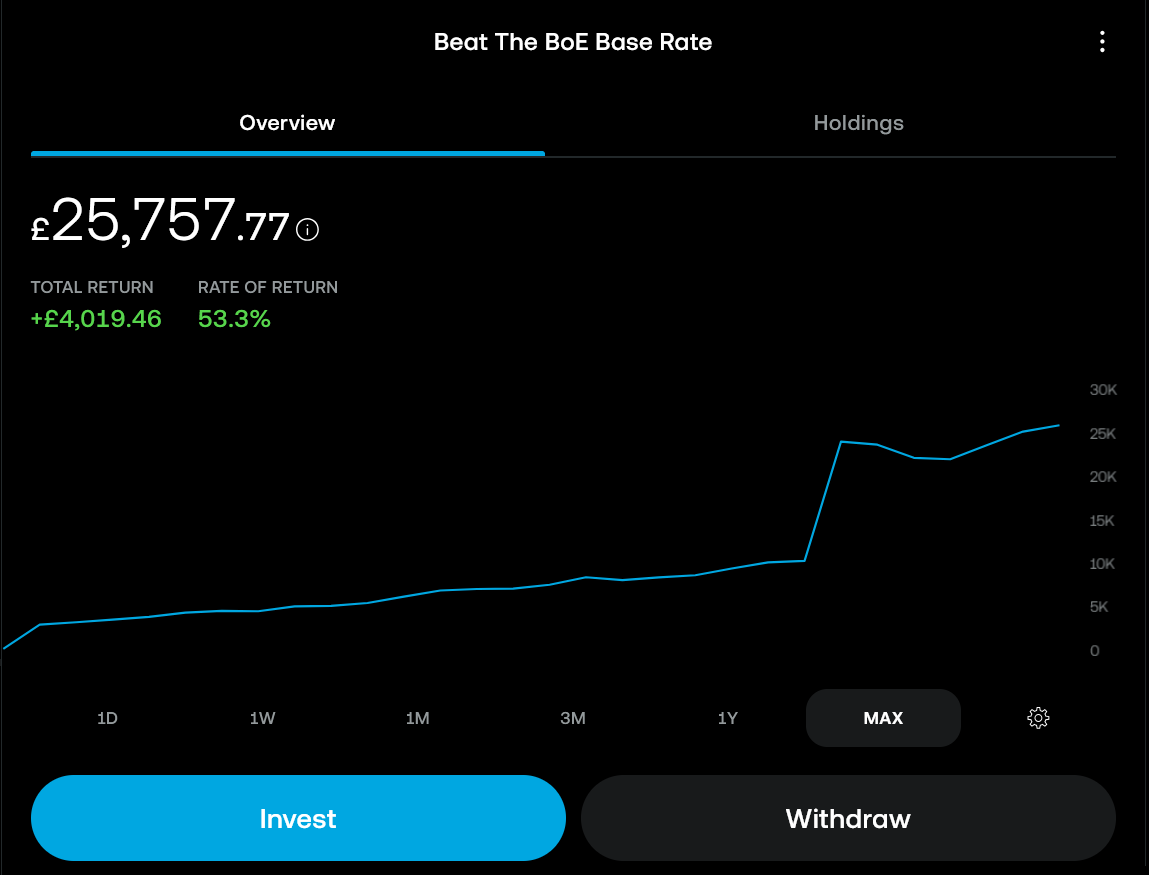

So without further a due, lets look at how my Stocks & Shares ISA is looking.

So if we compare this 6 months and 1 day ago where it was £23,445.41 it's a solid upward trend. Now before you get giddy, £1200 has been added by me in contributions since January (a monthly £200 investment).

So if you compare the two and include my contributions, that's about a growth of 4.52%. If I compare the value overall comparing then to now, its gone up about 9.9% in 6 months. Got to admit, its nothing to be sniffed at. So I guess this the moment where I cover my thoughts eh? Well here goes nothin!;

Sold

Ryan Air

As soon as I saw my very small holding go into profit I let it go. It was an interesting experiment but it hasn't really panned out. If I'm to invest in Airlines directly I suspect I'd have to probably look at IAG or Cathay Pacific or even Singapore Airlines (the latter 2 via Interactive Brokers). Problem with RyanAir I found they peak in seasons and they are not wholly sustained. Given they do peanut flights too they are heavily subject to strikes to whats going off in France so I thought best to cop out.

Bought

No further companies invested into other than what was listed before. I've been heavily tempted with a Gold ETF or even Swire Group but each carry an inherit risk. Swire Group is affected heavily by the Hong Kong/China market and given Trump and China aren't the best of friends, I need to do further research.

Future Changes

See above comments re gold and Swire Group.

Reviewing The Stock

An In-depth look at the investments

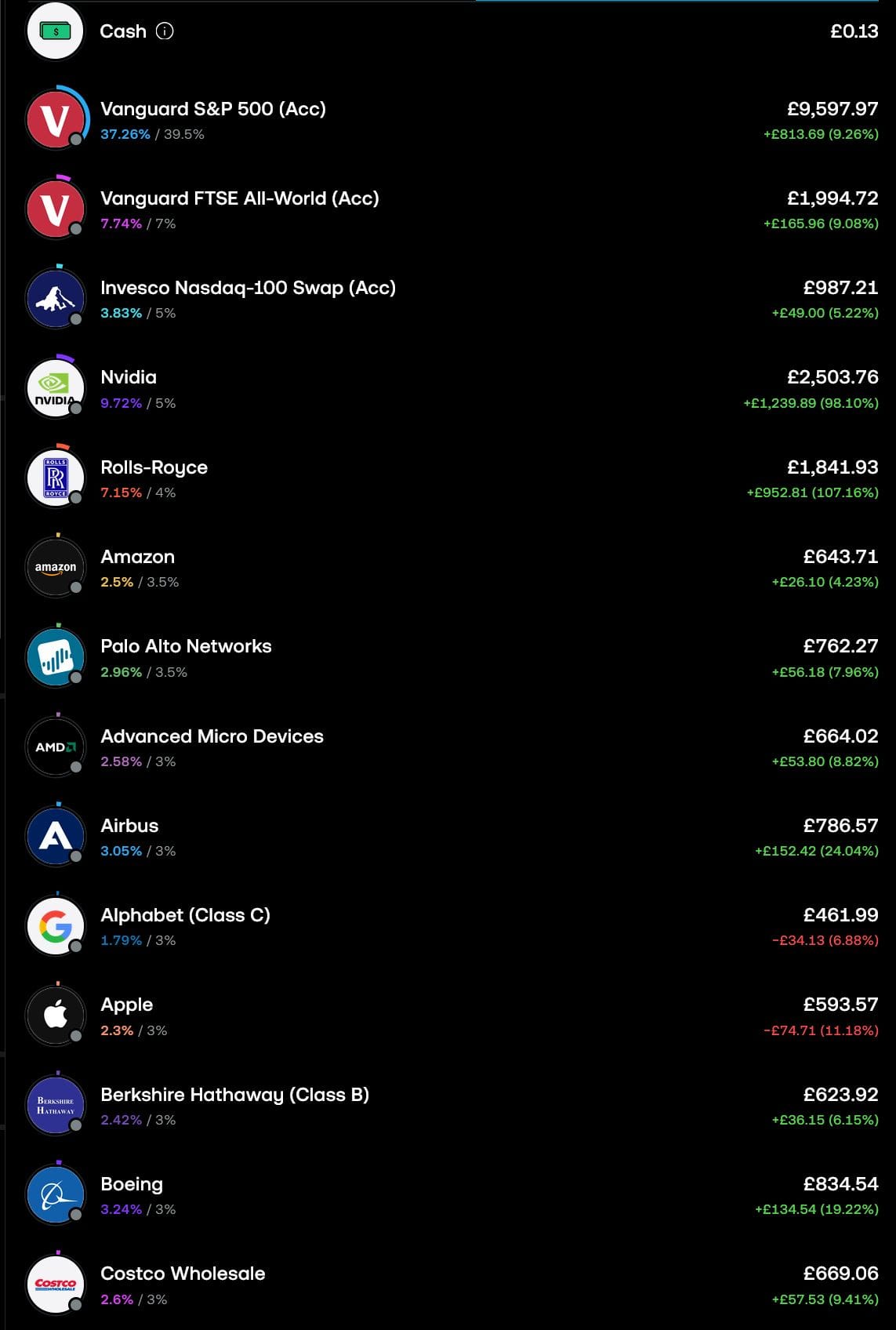

Vanguard S&P 500 (Acc)

Took a bit of a fair hit when President Trump introduced tariffs as we know. We're now seeing bouts of recovery, mainly because Trump rolled back on just about everything and the market is beginning to settle again. The S&P will still be here long after President Trump and I still believe that long run it will beat any individual investment made by any normal person made from someone like myself. As a stretch I'd like this around 15% growth by end of year, but we'll see.

Vanguard FTSE All-World (Acc)

Being in the S&P and the All-World index is the ultimate world counterweight. I mean you could argue just being in the All World Index should be enough but you just can't discount other markets out there. Again, I'd like to see this grow to around 13% before year end. Must admit in recent investments, I haven't added to this same as the S&P really as you'll see from my later comments.

Nvidia

Nvidia recently hit a 4 trillion market cap. Just let that sink in. 4 trillion. I've made very small further investments with caution. It's value is continuing to rise but I feel AI has to plateau at some point. AMD is catching up and I feel is a cheaper, probably a long term better bet. One thing I am keeping my eye on is Nvidia is looking into going towards doing their own SOC. This would be very interesting.

Invesco Nasdaq-100 Swap (Acc)

This experiment continues. Tech heavy ETF. Depending how I feel with this ETF, I may put 2.5% to Swire or Gold and then 2.5% to the All World Index come end of year. Depends how it looks I guess. It's interesting to watch though.

Amazon

Unless everyone stops buying online, can't see people not consuming from Amazon. Bare in mind they also now full rights to Bond so they are moving into movies. So Amazon's empire is;

- Sport

- Shopping

- Cloud Computing/Storage

- Movies

- TV

Am I missing anything? Probably will see slower growth given Movies, sport and TV costs will probably spiral.

Apple

An enigma. Really thought they would be pushing on but seem to be in this holding pattern. Maybe waiting for the anti-trust suit to settle and sort out before rolling a probable iDildo for women?

Palo Alto Networks

They continue to lead the Cyber Security space and given we're integrating more and more into an online world, being with some form cyber security company is bound to be good albeit niche. Growth continues to be good with the minor hiccups relating to breaches which get patched relatively quickly.

Rolls Royce

One of the stocks I've invested more heavily in. More because of my interest to the Ultrafan project. I believe it this can be scaled down, I think we'll see this as an engine option for Airbus' replacement for the A32x program. Could also argue they could replace the Trent XWB's too as a "Neo" option. Continuing my focus to aviation, if Emirates have their way its entirely possible you could have an evolved A380 or sorted. A385 anyone? lol

Turning your head a little, the mini nuclear reactor work and backing Rolls are getting is good news too. I've started to dial back my investment. When something has such a rapid rise I get a little uneasy. When its a slow rise, I can understand, rapid, I feel there is manipulation happening somewhere.

AMD

The stock that goes up and down. Still have faith in AMD for as long as Lisa Su is there. They seem to be on solid footing. AMD appears to be catching up pretty quick in terms of AI development in the data center world.

Airbus

A stock I've been continuing in investing in and proving good. Recent air shows have added more into their backlog. Again, it's good news. I suspect Airbus being European, will work with Rolls Royce and maybe CFM with the Open fan engine.

Still have this there, not added any more investment to it. Another one I may continue to hold or eventually sell off.

Berskhire Hathaway

Not added any further holding. Just holding at present.

Boeing

Added more in. When the Air India incident happened, I added more in again. Boeing will come out of this strong. The share I believe is still bigger than Airbus even with all the issues and more airlines especially Asian, are ordering Dreamliner aircraft and the new 777's...Mainly to appease on trade agreements but I digress.

CostCo

The craze of bulk buying still going strong. I will continue to build on this stock where possible.

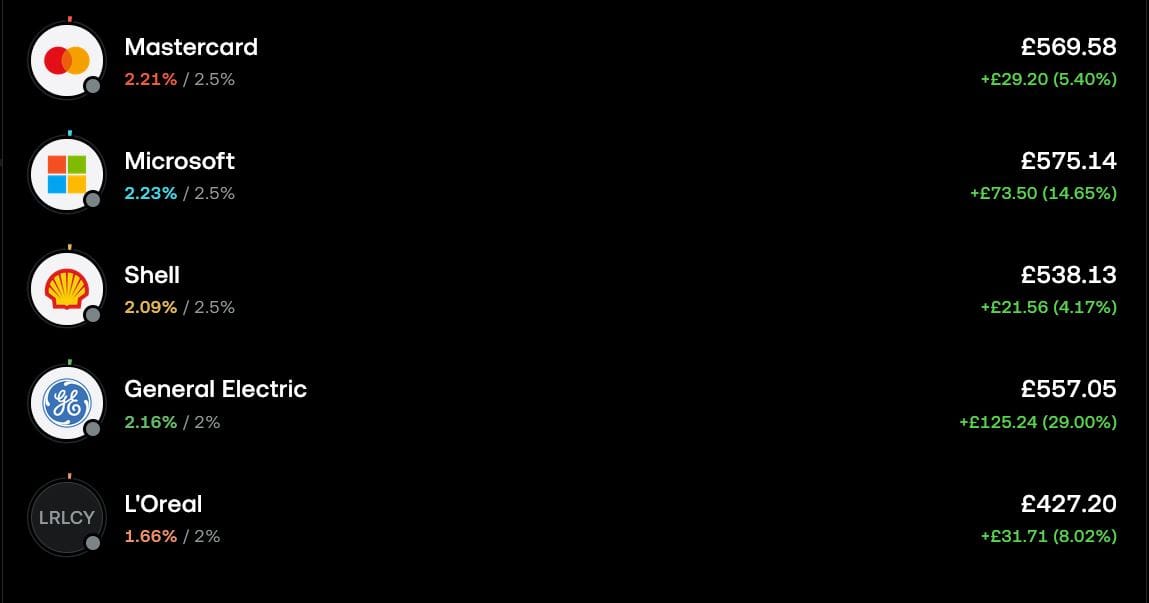

Mastercard

The looming redress for Mastercard hangs over the company but other than that, they will continue to growth I reckon.

Microsoft

Windows 10 ending, Windows 11 now becoming the main, Microsoft loves your data and they seem to be skimming down on the staff and cutting some costs. As a tech lover, I don't like it, as a share holder, a leaner business is better. Still a worthwhile investment but my focus has been on aviation and machinery.

Shell

Shell ain't going anywhere so I'm not. Nothing to add.

L'Oreal

I don't really fully understand why this stock is down to be honest because financials wise they look solid. I absolutely maintain this continues to be a good stock because every woman uses cosmetics and L'Oreal is so well known I don't see this not making a profit long term. It's being steady and adds diversification.

General Electric

Been investing more into this and proving well researched. The GEnx engine incident with Air India withstanding, the new upcoming engine for the new 777's will be surely successful as the testing hours have been considerable. Not to mention they have the largest wide body engine share.

Concluding Thoughts

Happy, would have been ecstatic if Trump hadn't fucked about. Keep investing and I'll keep picking what I invest in each month but the pie is pretty settled. Till next time all!